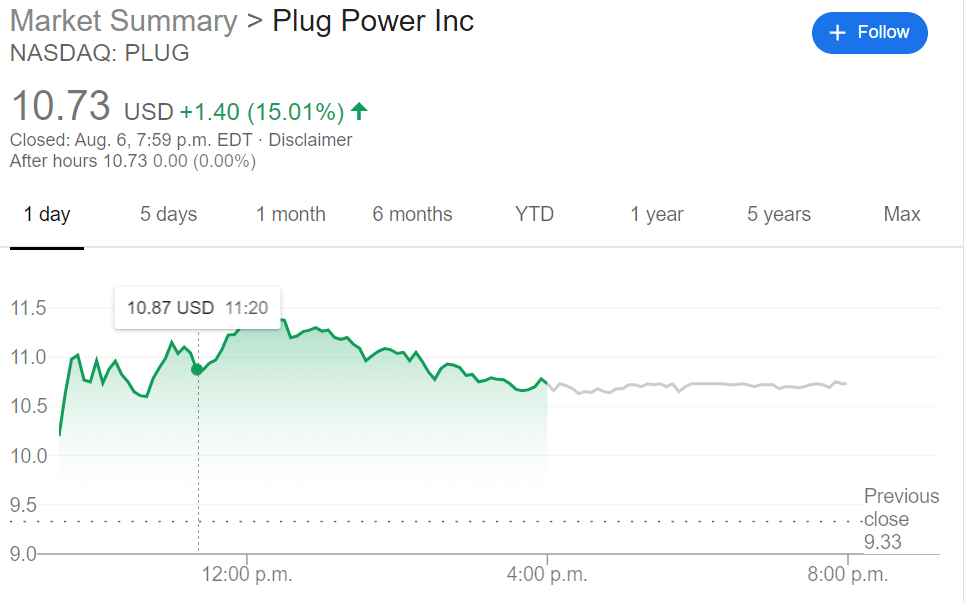

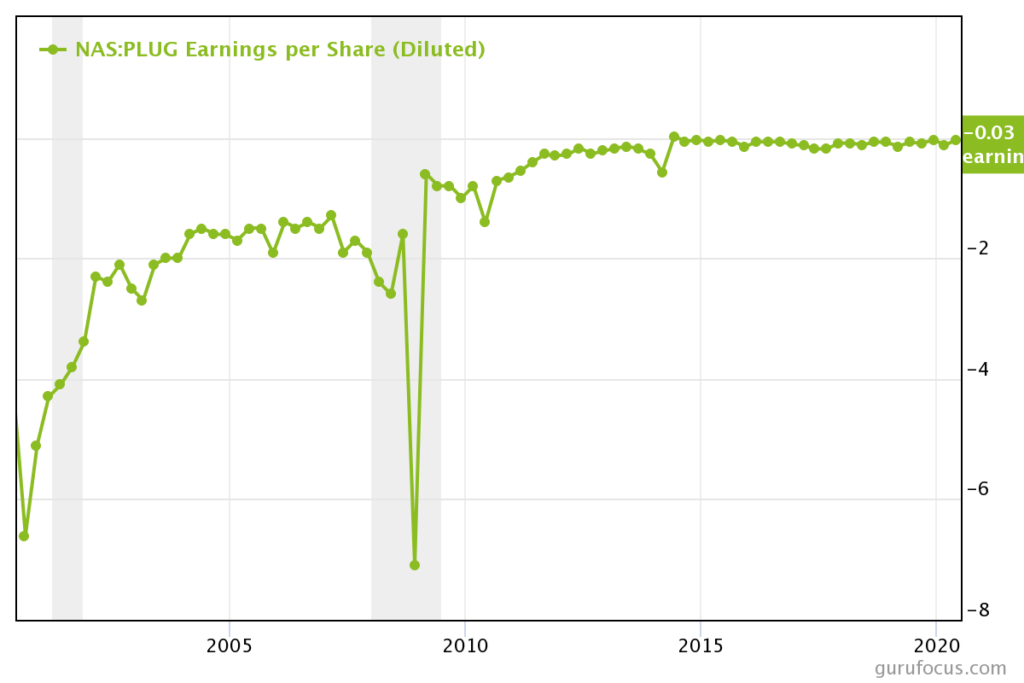

Ī conference call will be held today, March 1, 2022.īoth the shareholder letter and webcast can be accessed at on the company’s home and investor relations pages. The quarterly shareholder letter has been posted at. (NASDAQ: PLUG), a leading provider of turnkey hydrogen solutions for the global green hydrogen economy, has announced today its 2021 fourth quarter results. On the date of publication, neither Louis Navellier nor the InvestorPlace Research Staff member primarily responsible for this article held (either directly or indirectly) any positions in the securities mentioned in this article.LATHAM, N.Y., Ma(GLOBE NEWSWIRE) - Plug Power Inc. PLUG stock earns a D rating in Portfolio Grader. However, for now, avoiding PLUG stock, whether before or after earnings, remains the best move. If the company can’t, it’s not out of the question for the stock to ultimately trade at a discount.Īs always, positive surprises in the quarters ahead could change the story. On a longer time horizon, even if Plug Power builds a portfolio of tangible hydrogen product assets, it still needs to produce a profit with this infrastructure. At the end of 2021, the tangible book was about $1.22 per share higher than it is today.Ĭontinued cash burn will bring down this figure, which presumably means more room for shares to fall. Bottom LineĪssuming high cash burn continues with Plug Power, as it attempts to achieve profitability, I wouldn’t count on the stock’s tangible book value holding steady. Even if at first glance it may seem that the aforementioned tangible book value will serve as a floor, that may not be the case. If subsequent results cannot match up with these projections, PLUG is likely to keep tumbling. With this, it is highly questionable whether Plug Power will hit its revenue and gross margin targets ( $1.4 billion and 10%, respectively) for this year. That’s clear from Plug’s results in recent quarters. The company has repeatedly overestimated how quickly it can scale up operations and to reach positive gross margins. However, despite this big positive in Plug Power’s corner, it remains hard to be confident this will lead to strong results in the near-future. Still, its current share price is based largely on its potential to ultimately become a large, profitable energy company, thanks to the global pivot away from fossil fuels. Sure, the stock doesn’t trade at all that high of a premium to the company’s tangible book value of $6.10 per share. PLUG stock may trade for just a little over 10% of its ten-year high, but it is not a bargain at current prices. It all has to do with the discrepancy between Plug Power’s valuation and its likely long-term prospects. However, even if PLUG tumbles by more than a moderate amount, I wouldn’t recommend “buying the dip.”įurther steady declines are likely. After the last earnings release, PLUG stock experienced a moderate drop in price.

If the same sort of situation plays out again with these latest numbers, it could elicit a similar response among investors. To make matters worse, the company’s losses per share last quarter were much wider than Wall Street expected. Even as Plug reported strong year-over-year revenue growth, its top line fell short of estimates. Still, despite these downward revisions, there is still a strong chance that Plug Power disappoints with its latest numbers. Last month, consensus estimates for losses went up to 24 cents per share, and are now at 25 cents per share. Back in January, the sell-side expected the company to report losses of around 20 cents per share for the March quarter. Over the past month, analysts have walked back their expectations.

Post-market on May 5, Plug Power will report its fiscal results for the quarter ending March 31, 2023.

0 kommentar(er)

0 kommentar(er)